Consulting Contractor | What Does It Mean? A Simple Guide

Consulting Contractor: Differences Between Contractors and Consultants

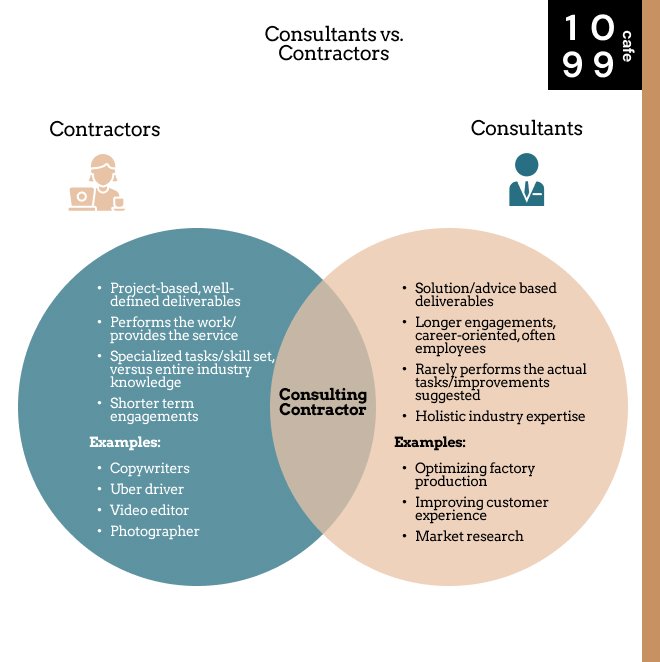

You may have heard of the terms consultants, contractors, independent contractors, freelancers, or even “consulting contractor”. What exactly do each of these terms mean and what are the differences? As the world of gig work expands, our vocabulary changes and traditional work structures have adapted. Today we’ll explore these terms and define them in detail.

If you want the short answer: generally, a “consulting contractor” would likely be considered someone who is providing professional advice or knowledge as a non-employee. This is in contrast to just a contractor, who usually actually does the work and generally on a project-basis.

contractors vs consultants

Contractors, Freelancers, Consultants: Same or Different?

Most of the time, you’ll hear the terms: contractors, contingent workers, freelancers, and independent contractors thrown around in the same context–because generally they refer to the same thing, which is a non-employee worker who commonly works on a project or hourly basis. These workers tend to provide actual deliverables, whether that be an edited video, a fully designed webpage, or a complete trip as an Uber driver. Businesses who hire contractors reap certain benefits–such as:

Specific skill set

Pre-defined deadlines and deliverables

Faster turnaround for projects

Quick hiring process

Lower commitment, no benefits or typical employee package

For the contractor, there are clear advantages to being a non-employee as well. Here are just a few:

You decide your rate, and amount of time you have to dedicate to a project or deliverable

You can decide when to work

You don’t necessarily report to anyone, instead your work is more focused on the deliverable

You may be able to work remotely

You can potentially make more than employees due to setting your own rate and having a specialized skill set

You may pay less taxes with write offs

With being a contractor, make sure you are familiar with the added responsibilities of reporting self-employment income, making quarterly tax payments, and organizing your expenses/1099s.

To make it more confusing, sometimes people even confuse the difference between vendor vs contractor.

What is a consultant?

A consultant technically has a bit more of a nuance. It tends to describe something a bit more specific. In our eyes, a consultant is someone that has professional expertise in a field, or particular project. They generally add value by providing advice and knowledge, instead of deliverables. Consultants can be loosely defined as “professional problem solvers”. A classic example and engagement may be illustrated like so:

A factory hires a consultant to help them figure out how to increase production

The consultant makes observations via onsites, interviews, being a part of the process

Based on their industry knowledge/expertise, the consultant provides specific advice or action steps, sometimes targeting specific milestones and goals

Often, consultants are actually full-time employees that work at large consulting firms like McKinsey, Bain, or Boston Consulting Group. Similarly, consulting roles are also available at Big4 companies like Ernst & Young, Deloitte, KPMG and PWC (not to be confused with Accounting roles). Consultants represent these companies and usually work with a team of other consultants with strict hierarchy, each with different roles. This relationship of consultants vs contractors can be compared in parallel to tax forms W9 vs 1099. In general, consulting as a service is a business to business transaction between larger corporations and engagements typically last quite long from 3 months to well over a year.

However, that doesn’t mean consulting only exists in this type of engagement–in fact there are many opportunities today where consulting has become a more open engagement with freelance capacity as well.

So, What is a Consulting Contractor?

Put simply, a consulting contractor is a consultant that works on a contractor basis. That means that they’re not full-time employees at the above-mentioned firms, and instead provide professional advice or knowledge on an hourly or project basis. These consultants find their own clients and don’t represent a 3rd party company.

What forms are relevant? 1099-NEC vs 1099-MISC

Regardless of whether you are considered a contractor, a consultant, or consulting contractor, you need to be familiar with tax forms. For freelance work, in general you would receive a 1099-NEC. Since 2020, the 1099-NEC vs 1099-MISC debate has been settled, since the IRS has reintroduced the 1099-NEC to capture all non-employee compensation. That means as a consulting contractor, you should receive a 1099-NEC from your clients after you’ve provided professional advice.

FAQs:

Is a consultant the same as a subcontractor?

A consultant can be a subcontractor, but generally consultants are full-time employees who provide professional advice/solutions. They usually represent a professional consulting company like McKinsey, or Bain. Subcontractors, on the other hand, are not full-time employees and generally perform actual services versus just providing advice.

Who is considered a consultant?

A consultant is generally considered as someone who has extensive industry knowledge and provides value-add by offering advice or proposing solutions to improve business operations. Some examples include advice on improving factory optimization, customer experience, or customer satisfaction.

Is a consultant a contractor?

A consultant CAN be a contractor. Some consultants are not employees and don't represent a consulting firm like Boston Consulting Group. Instead, these consultants can acquire their own clients and provide professional advice/solutions as a contractor, working as a non-employee.