Freelancer vs Self Employed | Main Differences

As a freelancer or business owner what is your title? Do you simply call yourself a freelancer? A contractor? Gig worker? What’s the difference between being a freelancer vs self employed? We’ll answer all these questions in this article and help you find your identity and reach your maximum potential.

Freelancer vs Self Employed: What’s the Difference?

The differences between a freelancer vs self employed are subtle. Oftentimes, there are no differences, and sometimes there are major differences–the first thing to remember is that they are not mutually exclusive. This means that you can both be a freelancer and also self employed. In most cases, people tend to get confused between what they call themselves, and how they might fill out a tax form or employment form.

Per strict definition, the terms freelancer vs self employed have no difference from a legal and tax standpoint–it’s simply a title or identity.

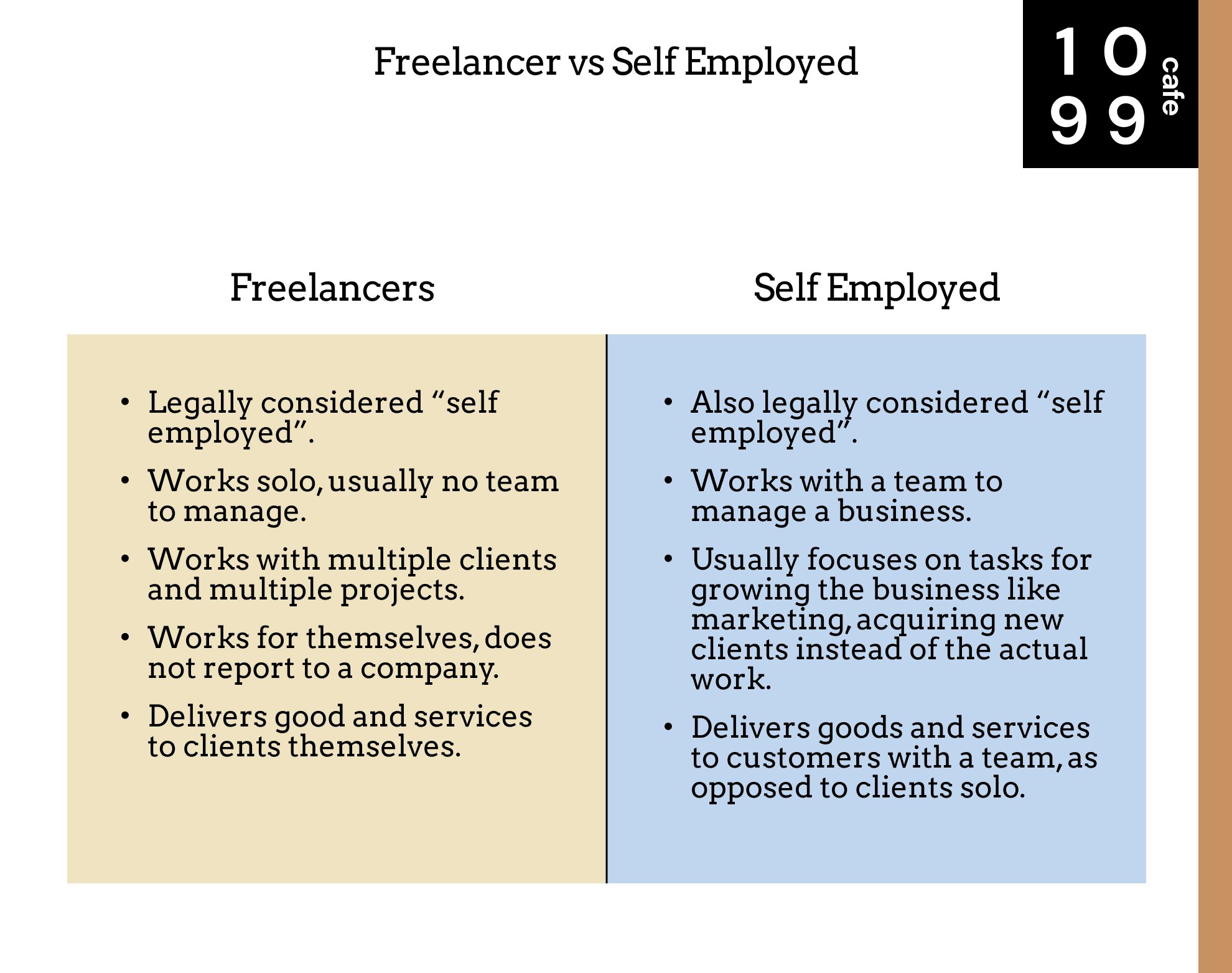

freelancer vs self employed: quick guide

While there’s no official difference, let’s start by defining each term used in modern context.

What is Freelancing?

Freelancing is the practice of generating income by completing projects for clients, without being employed. Even though the work may originate from a company, freelancers work for themselves and not the company. A freelancer typically has multiple clients and may have multiple projects with the same clients as well. Freelancers have almost complete autonomy, as they get to choose which projects to take on and which clients to work without a strict work schedule. However, freelancers don’t have complete autonomy, as they still need to cater to client needs. Typically, freelancers are working solo and focus entirely on getting the work done, without the help of a team or other contributors. Lastly, remember that a freelancer is technically “self employed” per IRS and legal standards.

What is Self Employed?

In modern context, being self employed typically means being a business owner, or managing a business. In being self employed, you have basically complete autonomy as you focus your attention on serving customers and how to improve the business to better serve customers. Your duties don’t usually involve doing the actual work, but instead managing a team of people and the business itself. For example, you may focus your attention on marketing and how to acquire new clients while your team actually delivers the product or service to the customers.

To provide more clarity, let’s compare freelancers vs self employed side by side.

3 Main Differences between Freelancers vs Self Employed

1) When it comes to taxes and legality, there’s no difference

If you’re a freelancer, you would still elect to be a “self-employed” individual when it comes time to do your taxes. There is no option to select a freelancer, or contract worker, or gig worker. The IRS treats this bucket of individuals all the same, simply as Self Employed.

In the same vein, when actually filing the taxes, the process is also similar between freelancer vs self employed. Both individuals would potentially receive 1099-NEC forms, and have expenses/write-offs on their Schedule C.

Similarly, if you’re filling out some application for a vehicle loan or other employment inquiries, there’s also only the self employed option.

2) When it comes to perception, there are some differences

Generally, people view the field of freelancing as

Someone who takes on projects, often from multiple clients, while working solo. Freelancing can be a full-time pursuit, or is often supplemental income.

Those clients can span multiple industries, and a freelancer has to manage their rates, hours, invoicing and general client relationships as well. In many cases, some consider freelancing volatile as an individual would have to constantly be acquiring new clients, if there’s any turnover. People also generally imagine freelancers as solo workers, taking on gigs and executing the work for themselves and rarely have a team of people they work with. This is not to say you can’t have a robust freelancing practice where you employ or subcontract work to other individuals–again, being a freelancer vs self employed are not mutually exclusive identities. Also, remember, from the IRS’s perspective, you are self employed.

On the other hand,

the term “self employed” tends to point more in the direction of a business owner who dedicates all of their time managing the business and a team.

For example, if you own a McDonald’s franchise, you could be considered self employed, but you also manage a large team of people. You manage their hours, their pay and also benefits. On top of that, you are responsible for the management of the actual business, which can entail a larger repertoire of responsibilities like safety, sanitation, marketing, etc.

Another example–perhaps you run a digital marketing agency to help businesses with elements like Facebook ads, Google ads, SEO, etc. You probably would hire freelancers to help you execute the actual work, while you focus on acquiring clients and marketing.

In summary, people and society generally regard freelancer vs self employed as:

Freelancers:

“Someone who works solo and relies on clients and multiple projects to make a living, or to have an added income source”

Self Employed:

“Someone who owns, or manages a business, with a team of people serving customers as their main source of income”

3) When it comes to day to day activities, there’s little difference

Both freelancers and self employed individuals have a lot of autonomy. They can typically choose when they work, what their rates are, and how they work. So when it comes to the “how”, freelancers and self employed individuals tend to have more similarities than differences.

To highlight some nuanced differences though:

Freelancers tend to work alone, and not have a team vs self employed individuals may own a business and manage a team.

Freelancers may actually “work for” someone in a non traditional sense, like clients. Self employed individuals tend to manage their own team and have customers, instead of clients.

Freelancers tend to have multiple projects or clients, whereas a self employed business owner just focuses their attention entirely on the business and customers.

Freelancers may treat their practice as side income, or added income to their full-time job. Self employed individuals tend to already be dedicating their full time to their business or practice.

Freelancer vs Self Employed: Which One is Better?

There is no “better” choice per se, it entirely depends on what your goals are and who you are as a person. At the end of the day, it’s just a title you call yourself. Remember, legally and for tax purposes, there is no difference–both freelancers and self employed individuals are just self employed. To help you decide, ask some important questions about yourself:

1) Are you looking to make some extra income, or to dedicate time to building something for the long term?

If you’re just looking to make extra income, it may not make sense to build an entire business and have to manage more things. You’re a freelancer.

If you’re looking to build something you would be proud of and thrive off tackling challenges and facing uncertainty, you are suited to be a business owner. You’re self-employed.

2) How much time do you actually have?

Are you swamped in your full-time job, but just need to make some extra cash? You’re a freelancer looking to supplement your full-time income.

Are you generally free outside of work and don’t have family obligations and are looking for extra fulfillment? Consider being self-employed and building a business.

3) How would you describe yourself?

Are you someone who would take great pride in building something? Being really hands on and learning hard lessons along the way? Consider being self-employed and building a business.

Or are you someone who prefers a more structured approach and letting clients dictate the scope of work to just make some cash? Consider being a freelancer as there’s less to manage and little management needed.

FAQs:

Are freelancers considered self-employed?

Yes–per legal and IRS standards, freelancers are considered self-employed. You must file your taxes as a business owner. Be sure to take appropriate deductions on your Schedule C.

Is a freelancer a business owner?

A freelancer is self employed, but not necessarily a business owner. Freelancers can operate under their own name, without a business. A business owner is also self employed, but typically has a separate entity name and manages a team of people.

What is considered a freelancer?

Put simply, a freelancer is someone who completes work for clients, but is not employed by a company. Freelancers work for themselves, even though the work can come from a company–they are considered self employed.