W9 vs 1099 | Freelancer Paperwork Explained

With countless IRS forms, it quickly gets confusing and you may be wondering what the difference between W9 vs 1099 forms is. In this article, we’ll provide a quick summary of what these forms are, who should use them, and how to fill them out.

First, let’s define each of these forms.

What is an independent contractor?

An independent contractor is an individual or entity that provides goods or services as a non-employee. That means that they’re not on payroll and do not receive a regular paycheck, or benefits like health insurance. The most common examples include realtors or real estate agents, Uber drivers, and DoorDash delivery drivers. Sometimes, when individuals with full-time jobs are seeking to make extra side income, they may send out private LinkedIn messages for networking and become an independent contractor when they win clients—contractors are more abundant than you may think. Contractors, or freelancers, are generally paid by the amount of hours they bill, or on a project basis. In this article we will talk extensively about Forms W-9 vs 1099, two documents that a subcontractor must be familiar with—but don’t get too attached to 1099s being associated with independent contractors, because LLCs do get 1099s as well.

For some individuals, they may even be both an independent contractor and have a full-time job. In this scenario, filing W2 and 1099 together can be a really complicated task.

W9 vs 1099 | What is a W-9 form?

A quick explanation of W9 vs 1099

Since our blog addresses topics from the freelancer’s perspective, we’ll keep that in mind as we explain topics. The W-9 form is a form that freelancers send to clients in order for them to have your information. The W-9 form contains basic information like:

Your Name or Business Name

Your business type (or sole proprietorship if no business entity)

Your address or business address

Your Taxpayer Identification number, which is either a Social Security Number (SSN), or Employer Identification Number (EIN) for a business

Do you need a W-9 for a 1099?

Yes–as a freelancer, you have to send your clients a W-9 with your information in order for them to send you a 1099. Clients rely on the W-9 Form to fill out and send out your 1099 forms.

The W-9 form is essentially informational. Clients will use this form to:

Keep accurate records of their freelancers/contractors

Use the information to fill out 1099 forms to send to you

Use address/contact information to send you 1099 forms

When to use a W-9 vs 1099?

The W-9 and 1099 forms do not act in place of each other. They are separate forms and generally freelancers will use both, for different purposes.

The W-9 is used by sending it to your clients with your information. The 1099 is generally a form you receive from clients that you use to file taxes. In some cases, if you have subcontractors that you pay to outsource your work, you may also send out 1099 forms to those subcontractors. At the same time, you should also receive a W-9 from those subcontractors as well.

| Who: | Freelancer (receiving payment) | Client (making payment) |

|---|---|---|

| What is sent: | Form W-9 | Form 1099 |

| How: | Freelancer fills out W-9 with information | Client fills out 1099 using W-9 and sends out 1099 |

| Why: | Freelancer sends W-9 so client has information about the freelancer | Client receives W-9 and uses it to fill out 1099 and send it out |

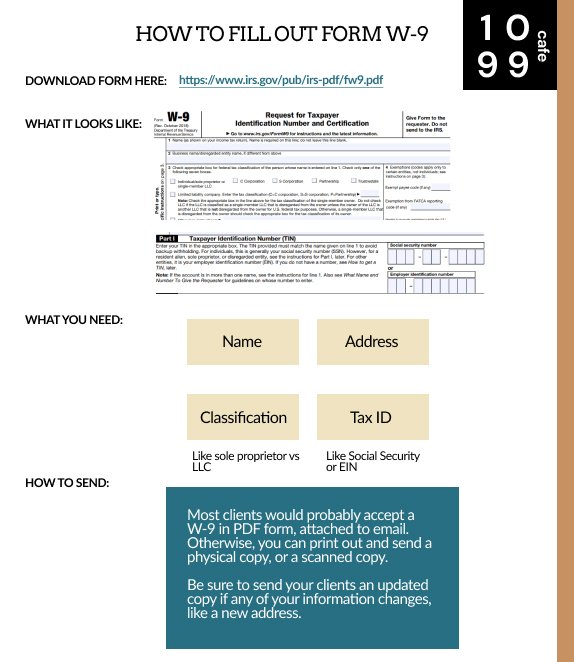

How to Complete a W-9?

To complete a W-9 form, you’ll need basic information like: your name, your address, your classification type and tax identification number. You can fill this information out in a PDF form downloaded right off the IRS website. Here’s a quick guide:

Summary of W-9 form

Note that if any of your information changes, you are responsible for sending to your clients an updated W-9. Remember, they rely on this information to send you your 1099s and for recordkeeping.

What is a 1099 Form?

The 1099 form (including MISC and NEC), is a form that you receive from your clients and it details how much you’ve been paid over the year. In order for the client to fill out a 1099 form properly, they must have your information. This is why you send them a W9 form.

How to Complete Form 1099

Generally, as a freelancer, you won’t be completing a 1099 form. Instead, you will be receiving one from clients who have paid you.

For some freelancers, maybe you have subcontractors that you outsource work too. If you’ve paid them over $600 in the course of a year, you actually have to send them a 1099.

To complete one, you’ll need all the information on the W-9, which they should send you. As a reminder, this is information like:

Name

Address

Classification type

You simply input their information and how much you’ve paid them. This can be done in PDF format with a form downloaded directly from the IRS as well.

In Conclusion: How to Use W-9 and 1099 Forms Together

In summary, as a freelancer, you typically send out the W-9 form to clients. At the same time, you typically receive 1099 forms from clients.

Here’s how you “use” each form:

W9 forms are used for relaying information to your clients about yourself, or your practice.

1099 forms are used for filing taxes, it provides information on how much you’ve been paid by your clients. It’s likely you will have multiple 1099 forms.

FAQs:

Do you need a W9 for a 1099?

Yes–W9 is used to relay information about a freelancer or their practice to their client. The client then uses that information to send the freelancer a 1099, which details your pay. The freelancer needs both to file taxes.

Whats better 1099 or W9?

There’s no “better” form. Contractors use both the W9 and 1099 forms for different purposes. A W9 contains information about a contractor and is sent to clients. A 1099 details how much was paid to a contractor from the client. Contractors need both to file taxes.

What is Form W-9 used for?

Form W-9 is used by contractors, or freelancers, for delivering information to clients. The W-9 form contains information about the contractor such as their name, address, classification type, and tax identification number. The client needs this info for recordkeeping, filing forms, and sending 1099s.

Do you neeYes–W9 is used to relay information about a freelancer or their practice to their client. The client then uses that information to send the freelancer a 1099, which details your pay. The freelancer needs both to file taxes.d a W9 for a 1099?

There’s no “better” form. Contractors use both the W9 and 1099 forms for different purposes. A W9 contains information about a contractor and is sent to clients. A 1099 details how much was paid to a contractor from the client. Contractors need both to file taxes.

Form W-9 is used by contractors, or freelancers, for delivering information to clients. The W-9 form contains information about the contractor such as their name, address, classification type, and tax identification number. The client needs this info for recordkeeping, filing forms, and sending 1099s.