W9 vs W2 | Tax Difference, Pros & Cons Explained

What is a W-9 | How to tell whether you need a W-2 or a W-9?

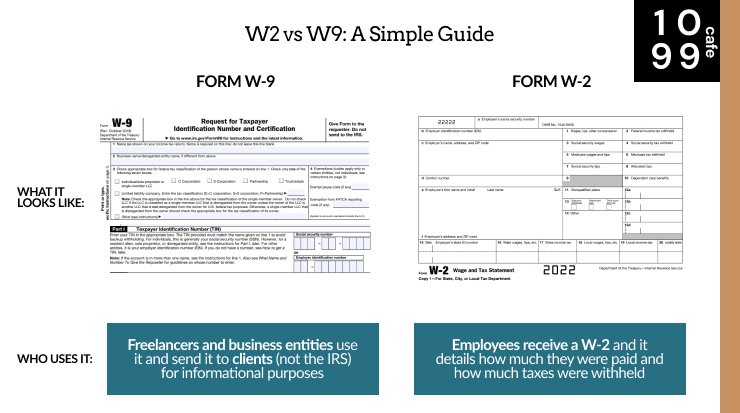

W9 vs W2? W4? 1099? If you’re confused about all these forms the IRS requires, you’re not alone! The naming conventions for these forms can be incredibly confusing and often does not provide any info around what the forms are for, who should use them and how to use them. Don’t worry - in this article, we will explain each form and outline what they’re for and how they’re used, in simple terms.

Here’s the quick and dirty explanations:

| W9 vs W2 | Form W-9 | Form W-2 |

|---|---|---|

| What: | A form freelancers send to clients/people who hire them. | A form employees receive from their employers at the end of year. |

| Who: | Freelancers. | Employees. |

| Why: | To provide information about yourself/your entity to clients. | Form W-2 details total wages paid and taxes withheld from all your paychecks throughout the year. Use it to file taxes at end of year. |

| How: | Download form here and fill out using a PDF editor and send as email attachment or physical copy. | Here's what the form looks like. You don't have to fill anything out, use the information to file taxes at the end of year. |

A W-9 captures information about a freelancer or entity that conducts business-to-business transactions. The freelancer or entity completes this form when a client requests it. You use this as a freelancer/contract worker.

A W-2 captures information about an employer and the wages it paid to an individual. A full-time employee would receive a W-2 at the end of the year, which summarizes the amount of income earned. You receive this as an employee.

It’s uncommon to use both of these forms, since most people either freelance, or have a full-time job. However, if you do both then it’s also very possible to encounter both forms.

What is Form W-9?

The W9 is an informational form you send to another individual or business. It captures very basic information like:

Name

What kind of entity you are (individual vs entity)

Address

Some identification number: Social Security Number (SSN, can also be referred to as Tax Identification Number or TIN), or Employer Identification Number (EIN)

Your signature

That’s it. Again, you send this informational form to other people so that they have your information so they can tally up how much money they’ve paid to you.

Another way to think about it: if you’ve ever received a 1099 form, the information is filled out using the information you provided on a W-9, or otherwise more informally. How else would a client have your information?

When to use a W-9?

You use a W-9 by filling it out with your information when another individual or entity hires you or your entity. For example, freelancing as a writer, you would have to send out W-9s to clients so they have your information. You may be wondering when NOT to use a W-9 as well, and the answer is: the W-9 is generally only used when making business-to-business transactions and those transactions add up to over $600. For example, a client hires you for freelance writing and has paid you $1,500 over the course of the year. They should be requesting a W9 form from you.

What is a W-2?

Unlike the W9, the W2 is a form you receive. Your employer sends you the W-2 when you are on payroll (typically meaning you have a full-time job). The W2 is a form that summarizes how much you were paid throughout the year and how much taxes were withheld (taken out of your paycheck). You’ll use the W-2 to enter income information at the end of the year. Here’s what info is on a W2:

Your employer’s name, identification number, address, and other info

How much your employer has paid you in wages

How much your employer has withheld from your pay

All of the above, at the state level

When to use a W-2

Typically, you don’t really do anything with a W-2, except receive it. You might be wondering when to expect your W-2 and it will vary across employers, but they are required to send you your W-2 by January 31st per the IRS. After you receive your W-2, you would “use” it to file income information before the annual tax deadline around mid-April.

Note that if you have multiple jobs, you can receive multiple W-2s, one from each employer.

Differences between a W-2 and a W-9, summarized:

W2 vs W9, simple explanation

As a freelancing individual/entity, you fill out and send the W-9. It contains your information

The W-9 is used for business-to-business transactions tallying over $600 over the year.

As an employee on payroll, you receive a W-2. It contains information about your employer

The W-2 summarizes employer information and income information for you to use when filing taxes at the end of the year.

Additional points:

IT IS possible to both have to send a W-9, and receive a W-2. Example: you have a full-time job, and also freelance on the side. Your clients will request a W-9, and your employer will send you a W-2 at year end.

Now that we’ve covered the critical questions, let’s address some other common questions/confusions:

What is the tax rate for W-9?

There is no specific tax rate for a W-9. Contrary to popular belief, a freelancer is taxed at the exact same tax rates as someone who has a full-time job. While we won’t cover this topic in full in this article, the primary differences when it comes to taxes between a full-time job and freelancers are the following:

Freelancers typically don’t have any tax withheld from pay. This means they could be surprised with a large tax liability at the end of the year and they should be making quarterly tax payments. But this doesn’t mean the tax is “more”.

Some people believe freelancers get taxed more through the “Self-Employment Tax”, but this is not true. In fact, the “self-employment tax” is simply the Social Security and Medicare taxes that everyone gets taxed for. These are government programs that your tax dollars support, which are separate from the generic tax rates you may be used to seeing on tax tables. The tax rates for Social Security and Medicare are 6.2% and 1.45%, respectively. This totals 7.65%

If you look at any pay stub, you would see taxes withheld for these two items. What’s different between full-time employees and freelancers is this:

Employers pay an equal share of 7.65% for a total of 15.3% combined between employer and employee.

For freelancers, you pay the full amount of Social Security and Medicare taxes (15.3%) upfront, however, you are allowed to deduct half as an expense at the end of the year.

Other Miscellaneous Topics:

Deductions for W-9 Workers | Advantages of W9 vs W2

Let’s help you save on taxes! Here are some common deductions you can take as a W-9 worker (or freelancer, or contractor, or gig worker):

Half of the Self-Employment Tax, or 7.65%

Any expense you incur for the operation of your freelance business. Common things include:

Mileage deductions if you use your car for business purposes

Software like Adobe Creative Cloud, Microsoft Office, Figma, QuickBooks Online, etc.

Supplies you use like: paper clips, K-pods, sanitary wipes

Dedicated office space like: WeWork, any commercial office, a portion of your home that is strictly used for business

Health insurance

Start-up and organizational costs

Business travel

Internet

Advertising

Difference between a w-2 and 1099

A W-2 is sent to an employee who is on payroll. It provides information about how much was paid to that employee and also provides information about how much tax was withheld from your paychecks.

A 1099 is sent to a freelancer/contractor/gig worker. It provides information about how much was paid to that freelancer. It DOES NOT have any tax withholdings – freelancers are responsible for paying taxes throughout the year.

Quarterly Tax Payments

Because freelancers typically do not have any taxes withheld from their pay, they are responsible for making estimated tax payments quarterly. You make these payments on both the Federal level and State level.

What is Form W-4?

A W-4 form only applies to employees that receive a W-2. It is used to determine how much tax is withheld from your paycheck. Basically, you put in a number on Form W-4, which translates to either more withholding, or less withholding. It doesn’t matter all too much–you either have overpaid your taxes at the end of the year (and get a tax refund), or you have underpaid your taxes (and owe taxes).

Comparing Forms W-2, W-4 and W-9

A W-2 is a form you receive as an employee. Contains information about your pay and taxes withheld

A W-4 is a form you send to an employer as an employee. It informs your employer how much tax to withhold from your paycheck

A W-9 is a form you send to your client/someone who pays you. Contains information about you, the individual, or your freelance entity.

FAQs:

Is W-2 or W9 better?

If you worked as an employee you will receive a W-2. If you completed any freelance work, you may be requested by clients to complete a W9. Neither is “better”, they are both required forms.

Do I pay more taxes with a W9?

When self-employed, you pay 15.3% self-employment tax, which is twice that of an employee. However, you can deduct half the amount when filing taxes. If you claim other deductions as a freelancer through operating your business, you actually may end up paying less taxes than employee counterparts.

Who is required to fill out a W9?

Freelancers and self-employed individuals who earn more than $600 will usually fill out a W9 and send it to clients.