What is Semi Monthly Pay | A Guide to Payroll

As a contractor, employee, or business owner–you may have wondered what the difference between semi monthly pay and biweekly pay is. In this article, we’ll explore both semi monthly and biweekly payroll types and their differences/advantages. If you’re an on-demand contributor like a freelance writer and do not get paid via payroll, this probably doesn’t apply to you.

What is Semi Monthly Pay? Types of Pay Schedules

Semi monthly pay is a type of pay schedule that pays out salaries and wages on the same two calendar dates twice a month. This means that pay is always distributed on either the 15th and the last day of the month, OR, the 1st and the 15th of the month. If a date falls on the weekend, then pay is generally distributed the Friday before the weekend.

Semi Monthly Pay for Salaried Employees

For a salaried employee, this also means that regardless of the length of the pay period, total annual pay is divided by 24 (2x a month, times 12 months). For example, in a month like February, the pay periods have unequal days: 1st - 15th = 15 days in pay period, but 15th - 28th = only 13 days pay period. Even though the pay periods are unequal, under a semi monthly pay schedule, you would get paid equally in every pay period despite having 2 fewer work days in that second pay period. Here’s how it would look with numbers:

You make $50,000 a year

$50,000 / 24 pay periods = $2,083.33

You would get paid $2,083.33 (before taxes) every paycheck, twice a month.

You will take home $2,083.33 x 2 = $4,166.67 minus taxes each month

Based on rough estimated of 25% tax, expect final take-home pay to be around:

$4,166.67 x 75% = $3,125 per month, or $1,562.50 every two weeks.

Semi Monthly Pay for Hourly Workers

For hourly workers, the pay period frequencies are the same (1st and 15th, or 15th and last), but the pay amount WILL differ. This is because hourly workers, or contingent workers do not make a set amount for the year. Instead, the hours have to be calculated for each pay period. In this case, there will be differing pay amounts for every pay period based on hours worked, length of pay period and also any overtime that may have been incurred.

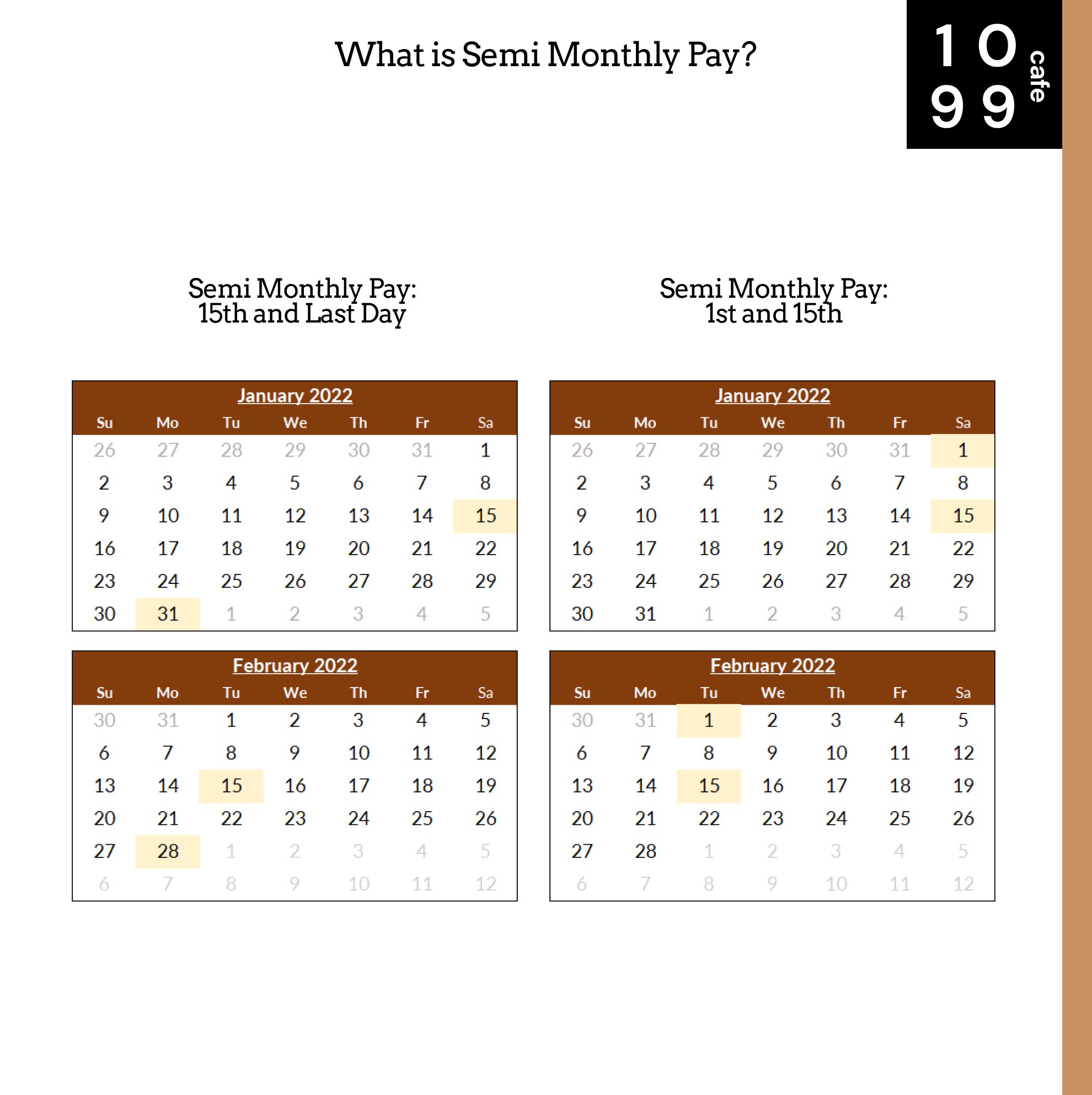

Here are examples of two months (including February) in 2022 and when semi monthly pay would be distributed in either choice:

what is semi monthly pay? two examples

Advantages of Semi Monthly Pay | Pay Schedule Consistency

Semi monthly pay is Consistent–because the schedule is very regular, you know exactly when to issue pay as an employer, or expect a payout as a worker.

Generally cheaper–because pay is issued in very regular intervals, there are fewer things to adjust for, like pay period length, rollover work.

Easier to manage–there are certain advantages for employers and workers alike. It may be easier to manage deductions that are withdrawn from each paycheck for both employer and worker since the payouts tend to be more regular and in equal amounts (if salaried).

If you’ve gotten this far, you might be wondering the difference between semi monthly pay and biweekly pay.

So, what is Biweekly Pay?

Biweekly pay is a schedule in which salaries and wages are paid out every other week, usually at the end of the week on Fridays. Here’s an illustrated example.

Semi Monthly Pay vs. Biweekly Pay: What’s the difference?

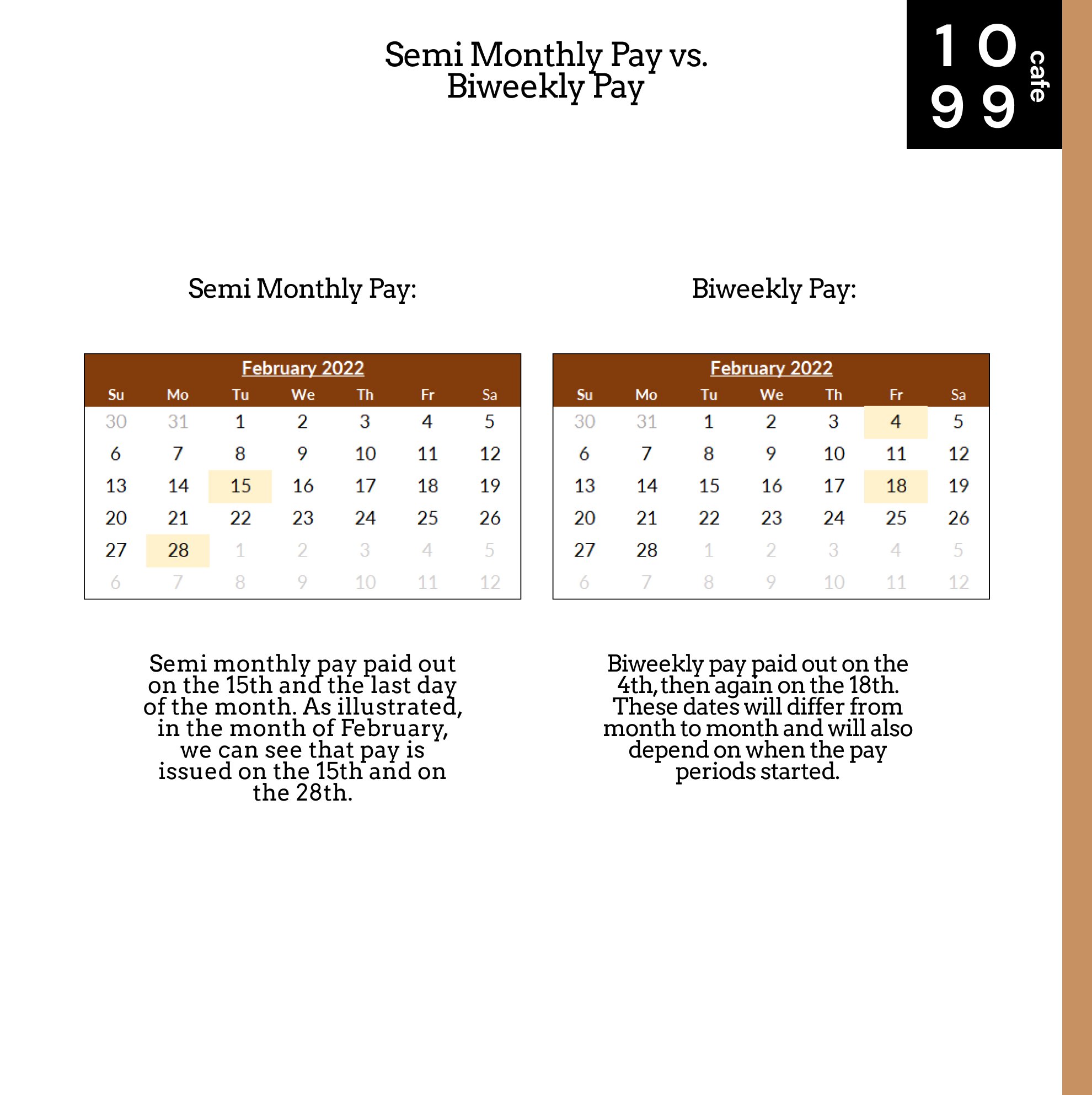

Although similar in language, biweekly pay is actually very different from semi monthly pay. Unlike a semi monthly pay schedule, biweekly pay does not always distribute pay on the same dates. Instead, pay is usually distributed every other Friday. You may think that payouts every other week coincides with the 15th and last day of the month, but actually–not really. Pay periods can start near the beginning of the month and payouts occur every other week from that point. Let’s visualize this in practice and also highlight some important differences:

semi monthly pay vs biweekly pay

Differences between semi monthly pay and biweekly pay:

Biweekly pay has more pay periods: Instead of strictly 2 pay periods per month for a total of 24 pay periods per year, biweekly pay schedules actually have 26 pay periods in a year.

Day of the week vs specific date: Biweekly pay schedules generally always pay on Fridays, instead of a specific date (like the 15th)

Pay amount: Because biweekly pay schedules have 26 pay periods, each payment will generally be less, but you receive 2 more payments which equalize the total pay in a year between the two method

Why do pay schedules matter? Isn’t it all the same?

While the end result is the same, there may be important considerations when deciding which pay schedule to use for payroll.

For employees, the biweekly pay schedule may be more favorable, since there are 2 months where you would receive 3 paychecks, instead of 2. Similarly, you can always expect a paycheck on every other Friday, which can make managing finances easier.

For employers, a semi monthly pay may be favorable, since the company has to process 2 fewer paychecks and there are specific dates for payouts which makes managing company cash flow more predictable.

FAQs:

Is semi-monthly 2 times a month?

Semi monthly pay does mean two times a month and on two specific dates–usually the 1st and the 15th, or the 15th and the last day of the month. If a date falls on a weekend, the payout occurs on the Friday before.

Is semi-monthly every 2 weeks?

Technically–no. A pay schedule that pays every 2 weeks is called biweekly versus semi-monthly, which pays out on the 1st and 15th, or 15th and last day of the month.

Which is better biweekly or semi-monthly pay?

There’s no real “better” method. Biweekly pay schedule pays out 26x a year versus semi monthly pay schedules paying out 24x a year. Biweekly pays less per paycheck, but has 2 more paychecks in a year and semi monthly pays more per paycheck, but has 2 fewer paychecks in a year.