California Dream for All | CalHFA’s Shared Appreciation Program

On March 27th, 2023, the state of California launched a new program to help first time homebuyers with their down payment called the California Dream for All Program. This new program is subject to income limits and is only available for first time homebuyers, but is an outstanding option for those who do not have enough saved up for a down payment to qualify for a traditional home loan.

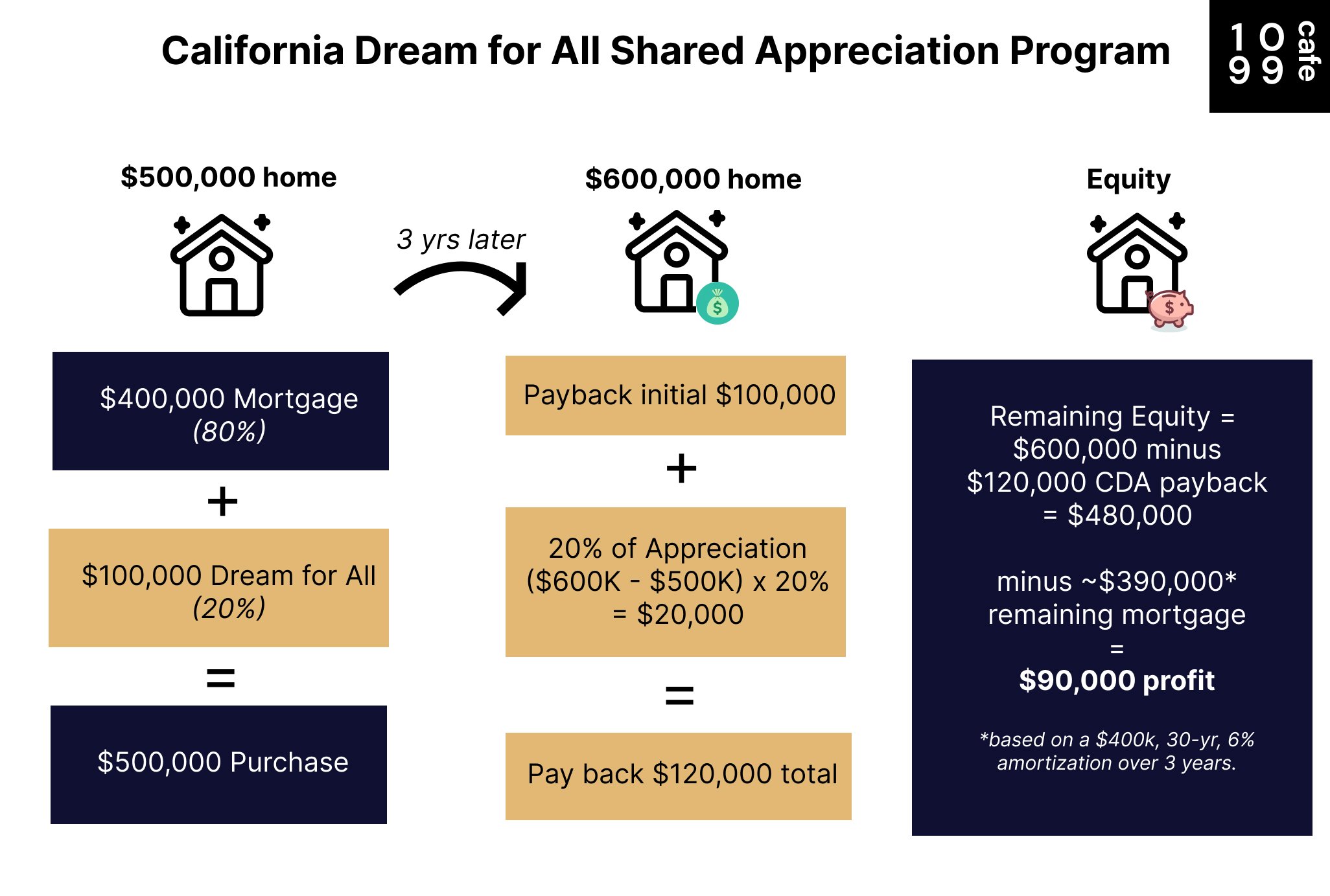

In summary, if you’re a first time homebuyer and you don’t have enough cash saved up for a down payment, the new California Dream for All program issues a separate loan for your 20% down payment. You don’t pay back the 20% down payment loan until you sell your home. In return, you pay 20% of the appreciated value as the form of “interest”.

How does the California Dream for All Program (CDA) Work?

You might be wondering–how does this program work exactly? Let’s talk numbers.

California Dream for All Program explained

The California Dream for All Program is offered by the California Housing Finance Agency (CalHFA)

Say you’re interested in buying a $500,000 home, and you don’t have any cash saved up. Most banks and lenders will want you to put down 20% or more for a down payment, otherwise you can’t get a loan. This means you would need $100,000 in cash, and finance $400,000. For many people, this may be too difficult, or impossible.

Under the California Dream for All Program, the state will provide you a second (junior) loan for 20% down. In this case, the state loans you $100,000 and you still finance the remaining $400,000. This means that you don’t need to put up any cash upfront, other than closing and financing costs. Then, when you sell your home, which can be 5, 10 or 15 years down the line, you pay back the original loan balance of $100,000, plus 20% of the value it gained.

If your $500,000 house appreciated $100,000 and is now worth $600,000–you would pay the original $100,000 back, plus 20% appreciation, = $120,000 total.

With this program, you’re effectively able to put 0% down and defer paying back the loan until you sell your home.

If your home hasn’t appreciated, or dropped in value, you would only need to pay back the 20% loan amount.

How do the monthly payments work under Dream for All?

You don’t make any monthly payments towards the 20% down from CDA, only on the remaining 80% you are financing. In fact, you can save on Private Mortgage Insurance (PMI) because you have 20% down!

Here’s an illustrated example of monthly payments between a 3.5% down using FHA, or 20% down using California Dream for All loan:

Monthly payments under California Dream for All

Monthly payments under FHA 3.5% down payment

Is this a bad deal though? 20% seems like a lot?

It’s not a bad deal. Using the previous example, let’s say you sell your home 5 years later and it gained $100,000 in value. Just to keep things simple, If we compare two 30-year loans at 6% interest–one for $500,000 and one for $400,000, you actually would pay an additional $29,027 in interest with the $500,000 loan. This is compared to 20% of the $100,000 appreciation, which would only be $20,000.

Obviously, this is just one example. But let’s how it looks if your target house was $800,000 and it appreciates to $1,000,000, 5 years later.

This means we would be looking at financing $800,000, or $640,000 under the California Dream for All.

Additional interest paid on $160,000 is $46,444 versus 20% shared appreciation of $200,000, which is $40,000.

Who Qualifies for the California Dream for All?

Here’s the qualification list:

Must be a first-time homebuyer in California, which means you either never owned a home, or you can also have owned a home 3 or more years ago and have sold it.

Must live in the property that you are planning to buy

Must not have co-borrowers or co-signers that do not intend on living on the property

Must meet income restriction requirements. For example, in Los Angeles County, you cannot make more than $180,000 per year. For the full list of income restrictions, read CalHFA’s PDF here

How Do I Apply for the California Dream for All?

To apply for the CDA Program, you must contact a qualified lender–we can also direct you to partner lenders in our network. You should be prepared with the following information and documents:

Pay stubs

Bank statements

Employment history

Previous tax returns

After you’re approved, you must also take some courses and education requirements.

FAQs:

What is the California Dream for All?

California Dream for All gives first-time homebuyers the option to get assistance with the down payment or closing costs up to 20%. It’s paid back, plus 20% of appreciation, when the home is sold.

How much down payment assistance can I get in California?

The new California Dream for All Program can provide assistance up to 20% of the down payment.

Historically, home buyers could borrow up to $15,000 under the MyHome Assistance Program.

What is the biggest negative when using down payment assistance?

Depending on your loan amount, interest, etc. it could cost you more over time

You could overextend on debt

Closing on a home could take longer, which means you could lose to other competitive offers