Fee Simple vs Leasehold | Types of Real Estate Ownership

If you’ve tried to rent commercial property or land, you may have come across the term “leasehold” and “fee simple” and wondered. What’s the difference between fee simple vs leasehold? Today, we’ll talk about common ownership types in real estate and how they’re defined.

What is fee simple?

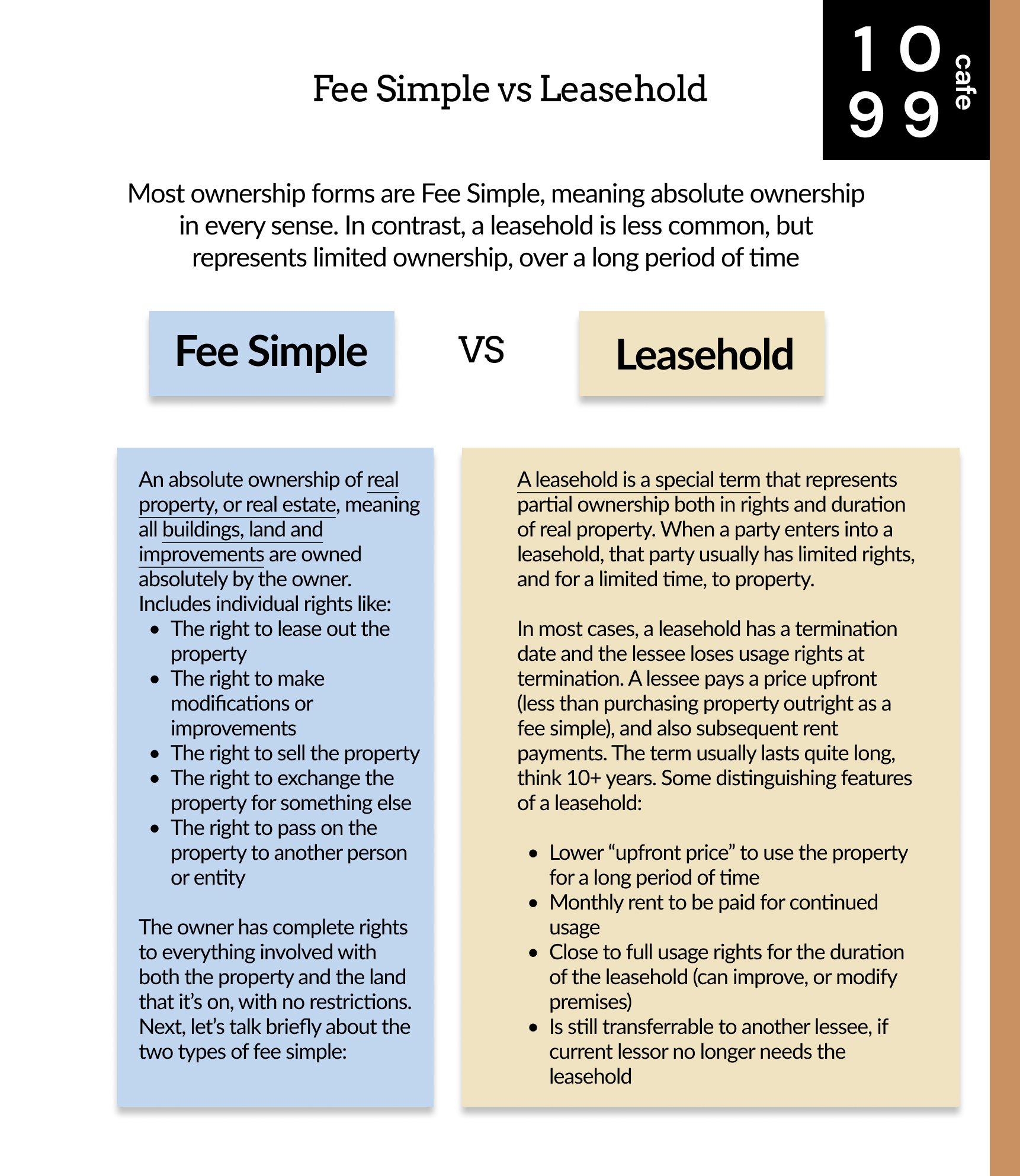

Fee simple is as the name implies—simple. It is an absolute ownership of real property, or real estate, meaning all buildings, land and improvements are owned absolutely by the owner. This is the most common type of ownership in real estate. Put simply, if someone has a fee simple interest, or ownership, that person owns all rights in perpetuity for both the buildings and the land (and even the air!) it’s on. This includes individual rights like:

The right to lease out the property

The right to make modifications or improvements

The right to sell the property

The right to exchange the property for something else

The right to pass on the property to another person or entity

The owner has complete rights to everything involved with both the property and the land that it’s on, with no restrictions.

Next, let’s talk briefly about the two types of fee simple:

Fee Simple Defeasible

A subcategory of fee simple, fee simple defeasible is a type of fee simple where real property is transferred from one person to another, with conditions. If those conditions are not met, then the property can be reverted back to the original owner. If the conditions are met, then the fee simple defeasible acts as a regular fee simple, with all rights unrestricted. Think of it as a fee simple, with some conditions that cannot be broken.

Fee Simple Absolute

Fee simple absolute is what we discussed earlier. Usually, when someone says fee simple, they mean fee simple absolute. This just means what was outlined earlier, meaning complete and unrestricted rights to real property, or often abbreviated as just “fee simple”.

What is a leasehold?

A leasehold is a special term that represents partial ownership both in rights and duration of real property. When a party enters into a leasehold, that party usually has limited rights, and for a limited time, to property. In most cases, a leasehold has a termination date and the lessee loses usage rights at termination. A lessee pays a price upfront, and also subsequent rent payments. The term usually lasts quite long, think 10+ years.

A leasehold is very different from fee simple ownership. In a leasehold, a person has ownership of a home or structure on the property, but not of the land itself. In fact, the holder of the leasehold has to pay the fee simple owner a “rent” to use the property and only for a limited number of years. A leasehold is also often referred to as a “ground lease”, especially in commercial properties. This is to denote that the lessee does not have ownership of the land.

To clarify, the holder of a leasehold is known as lessee, and the fee simple owner is known as the lessor. When in a written contract, the fee simple owner (lessor) has entered into a leasehold agreement with the lessee.

Advantages and Disadvantages of a Leasehold:

Advantages:

Lessees of a leasehold pay much less for the ownership of a leasehold. For example, leasehold ownership on a commercial property of 25,000 sqft might be $1,000,000 upfront and for 25 years, but fee simple ownership could be $3,000,000+

In the event that the lessee no longer needs the leasehold, they are typically allowed to sell the remaining duration to another party

Disadvantages:

Lessees of a leasehold do not build any equity in the real property they have ownership over

As a leasehold approaches expiration, it may become more difficult to sell, or exit, the contract

Other fees like rent or HOA fees or charged separately from the purchase price of the leasehold

So is a leasehold just a regular rent agreement?

Not really. Your typical rental agreement, while it is a lease agreement, usually doesn’t have the same rights, duration, and upfront costs as a formal leasehold. In a leasehold, lessees often have to pay something upfront in addition to monthly rent.

The upside of having a leasehold over traditional rent is that you will have access to more ownership/usage rights. In a leasehold, the lessees can remodel or make improvements as they see fit during the term of the leasehold. Similarly, in contrast to a regular lease agreement that may last 12 months or less, a leasehold can easily last 10+ years. If the lessee of the leasehold wants to terminate early, they would have to figure out how to sell the remaining term to another party.

Lastly, at the end of the leasehold period, all ownership rights return to the original fee simple owner, this process is called reversion.

Examples of Fee Simple and Leasehold Transactions

Fee Simple Ownership:

An individual owns a single family residence in Los Angeles, valued at $850,000. The ownership has no restrictions whatsoever, and is considered a fee simple ownership. This owner then decides to sell his property and accepts an offer from a buyer at $850,000.

After the escrow period and the transaction closes, the title of the property is transferred via a grant deed to the new owner. The new owner now owns the property, also with fee simple ownership. This means that the new owner has full, unrestricted rights to use, sell, transfer or modify the property, including the land (and air) in perpetuity until that right is transferred to the next owner.

Leasehold Ownership:

A commercial property is listed at $750,000 as a leasehold for 25 years. Similar commercial properties at the same size or square footage usually go for $2,000,000+. However, because this ownership is a leasehold, the buyer gets a “discount” in exchange for usage only during a limited time, instead of in perpetuity.

In this example, the potential buyer would pay $750,000 (can be financed with a loan) and then also a monthly rent to the fee simple owner for the duration of 25 years. After 25 years, the leasehold expires and ownership reverts entirely to the fee simple owner.

A leasehold ownership structure is more rare on a residential property. Typically, you’ll see these types of properties in Hawaii, where land is extremely valuable due to desirable beach and shoreline features.

Should I Buy a Leasehold?

There’s no completely right or wrong answer. Generally, if you don’t quite understand fully what a leasehold is, you probably shouldn’t buy one. Remember that in a leasehold ownership:

You don’t build equity

You may be attracted by the allure of a lower price

Rights are less clear and may have some restrictions

Ownership is reverted back to the original owner at expiration

For some, a leasehold can make a lot of sense. Prudent investors or business owners can gain entry into an investment or business opportunity at a lower upfront cost with the right leasehold.

In sum, consult an expert–whether that be a real estate agent or attorney to get sound advice.

FAQs:

Which is better leasehold or fee simple?

They are different. A leasehold is cheaper upfront, with additional monthly rent payments and limited time of ownership. A fee simple is more expensive and comes with absolute and perpetual ownership.

What is the difference between leased fee and fee simple?

Most full ownership of properties or fee simple, with absolute ownership and no restrictions. A lease is typically only usage ownership and for a short duration (like renting or leasing an apartment).

What does fee simple mean on a property?

Fee simple means the maximum and most absolute ownership in a property of infinite duration. A fee simple ownership grants the owner the right to sell, transfer, exchange, modify and use the property in any way possible.