1099-K vs 1099-NEC | 2024 Freelancing 1099 Forms Guide

In the world of freelancing and entrepreneurship, we’re often littered with confusing vocabulary, tax forms and industry jargon. To make things more confusing, the IRS is playing catch up with regulating the freelance economy and ecommerce, so rules are constantly changing and what you thought was right, may change at any time. For example, the 1099-MISC is used differently today versus just a few years ago–right when everyone was starting to understand and get used to the rules. Today, most of what the 1099-MISC forms covered is now covered by the 1099-NEC. To make things even more complicated, recent regulations have expanded the 1099-K, which we will cover in this article.

More specifically, we’re going to talk about the differences between 1099-K vs 1099-NEC and highlight scenarios when you would receive each form, and how to use them.

What’s the difference between a 1099-K vs 1099-NEC?

To put it simply, the 1099-K is a form you would receive if you received payments via providers like PayPal, Venmo, Stripe, credit card companies, etc. and a 1099-NEC is a form you would receive if you were paid directly by a business via cash, ACH, or check.

If you’re a W2 worker who receives semi monthly pay, this probably does not apply to you, unless you conduct additional work for side income.

| 1099-K | 1099-NEC | |

|---|---|---|

| Who receives them | Individuals or businesses who have received money from payment providers like Paypal, Venmo, credit card companies, etc. | Individuals or businesses who have received money directly in cash, check, or ACH |

| Who sends them | Payment providers, businesses/individuals, or platforms that facilitate payments through payment providers. Examples:

|

Businesses/individuals who have paid contractors directly via cash, check or ACH. Common examples include: Businesses that paid a contractor for a short-term project |

| How to Use | Use 1099-K to file summarized income on Schedule C during tax time | Use 1099-NEC to file summarized income on Schedule C during tax time |

1099-K and 1099-NEC summarized

Who, What, When | 1099-K Forms Explained

Historically, the 1099-MISC was the most recognizable form, followed by the 1099-NEC and they were part of the IRS’ designated forms for non-employee income, or non-W2 income. Nowadays, the rules have changed significantly and we are seeing more 1099-NEC forms and will be seeing more 1099-K forms.

The 1099-K was drastically changed recently. Prior to 2022, the 1099-K was rare and was only sent to:

businesses or individuals who had $20,000+ in payments specifically from payment providers and,

had over 200+ transactions conducted

This made it a very narrow pool of recipients. However,

from 2022 onwards, those 1099-K requirements will be eliminated and basically payment providers will be required to send out 1099-Ks if transactions exceed $600 over the year for any number of transactions.

1099-Ks are sent to businesses or individuals who received money from payment providers like credit card companies, PayPal, Venmo, Stripe, etc. Recipients of 1099-K can range from occasional Uber drivers who receive compensation, to large ecommerce businesses who receive payments from Shopify. 1099-K forms will summarize total payments received for the year, and you should receive one for each payment provider. For example, if you have both a PayPal and Venmo account and have received payments from them, you should receive a 1099-K form for each account.

1099-K forms should be sent by January 31st of the subsequent year—for 2022, you should receive your 1099-Ks by 01/31/2023.

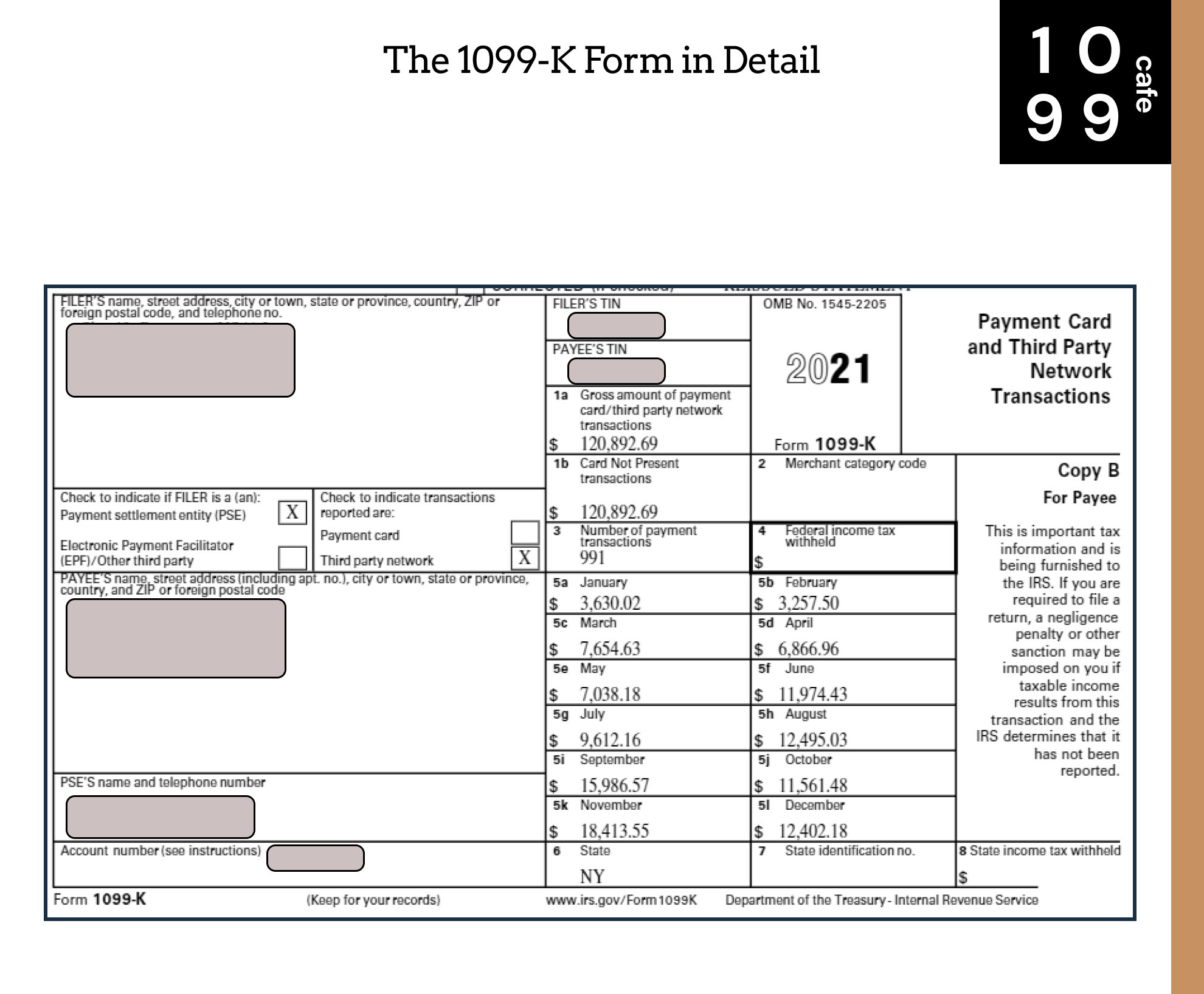

The 1099-K Form In Detail

An example of the 2021 1099-K Form

Box 1a: Gross amount of payment card/third party network transactions

Simply the total amount you were paid via the payment provider

Box 1b: Card Not Present transactions

The sum of the transactions that occurred without the physical presence of a credit card. In most cases, this will match Box 1a, since generally the transactions are going to be digital.

Box 2: Merchant category code

The industry code that your business or practice is categorized under, per the payment provider. For example, if you sold boat and motor vehicle parts, you might be categorized under the NAICS, or merchant code, of 44122

Box 3: Number of payment transactions

Simply the number of transactions that your total amount was comprised of

Box 4: Federal income tax withheld

Very uncommon to have anything in this box, but If you have any taxes withheld to prepay your tax liabilities, it would show up here

Box 5a - 5l: Monthly breakdown

The monthly breakdown of your Box 1a amount

Box 6: State

The state that your business or practice is in

Box 7: State identification no.

If the merchant has this info on file and your business has a business ID no. in that state, it would show up here.

Box 8: State income tax withheld

Similar to Box 4, usually empty, but would contain any taxes withheld for state tax liabilities, if applicable.

What about Personal Friends & Family Payments for 1099-K?

To be clear, 1099-K forms should only be issued for business transactions. This means that if you Venmo or PayPal your friend, your family, or a roommate, they should not be receiving a 1099-K. They would only receive a 1099-K if you designate the payment as “goods and services”, which would categorize it as a business transaction.

What is a 1099-NEC vs 1099-MISC?

The “NEC” in 1099-NEC stands for “Nonemployee Compensation” and the form is relatively new and was reinstated to better categorize freelancer payments. In the past, most 1099 jobs and contract work payments were summarized on the 1099-MISC, but that changed in 2020. To create a clearer distinction between actual miscellaneous payments and contractor payments, the IRS reintroduced 1099-NEC to specifically capture nonemployee compensation, meaning freelancer, contractor, or contingent worker payments. Now, the 1099-MISC is uncommon and more appropriately used for miscellaneous payments like:

Royalties

Rent income

Attorney fees

Nowadays, if you’re a freelancer/contract worker and not an employee, you should be receiving a 1099-NEC from any business or individual who has paid you over $600.

How to use the 1099-K vs the 1099-NEC in Tax Filing?

During tax time, it’s relatively straightforward to use your 1099 forms. Focus on Boxes 1a and 1 for the 1099-K and 1099-NEC respectively. These amounts will be added up and be entered into your Schedule C under Business Income along with any other income you may have, like Instacart earnings.

1099-K vs 1099-NEC in Tax Filing

Your Schedule C is a detailed breakdown of all your business income, including freelancing gigs, businesses and any other self-employment income. This would be combined with your W2 income, if you also have a full-time job, which would all ultimately be summarized on your 1040 form to be filed with the IRS.

FAQs:

Do I have to file both 1099-NEC and 1099-K?

If there are payments overlapping on both forms, only file the 1099-K. Otherwise, you should be receiving each form separately: 1099-Ks from payment providers like Venmo, PayPal, or Stripe and 1099-NECs directly from businesses who paid you. Make sure that the forms are not overlapping or double-counting. Due to new regulations, there may be 1099-NEC payments that are part of the 1099-K already, it’s your responsibility to have an idea of how much your payments should be.

Why did I get a 1099-K and 1099-NEC from Uber?

If you’ve earned more than $600 from referrals and other incentives, Uber will send you a 1099-NEC which summarizes those payments specifically. Separately, Uber sends the 1099-K form which contains the majority of your pay for deliveries and driving passengers.

What is a 1099-K form used for?

The 1099-K form is used to summarize payments made from Payment Settlement Entities (PSEs) like Venmo, PayPal, Stripe, or credit card companies (Visa, AmEx, Mastercard). For example, you drive for Uber and you were paid through Stripe, your pay will be summarized on a 1099-K. These payments should be separate from your 1099-NEC forms.