Simple Rate of Return | Easy Business Decision Making

Have you ever come across an investment opportunity, or a business opportunity and wondered if it was worth it? A simple rate of return formula can help you actualize whether an opportunity is worthwhile. Let’s explore this definition in detail.

What is the Simple Rate of Return | An Easy Way to Measure Value

Much of what’s in the finance world can be overly complicated, but today we’re going to talk about something so simple that after this article, everyone should know how to evaluate whether something is worth pursuing: the simple rate of return.

The simple rate of return = (Ending Value - Initial Value) / Initial Value x 100%.

That’s it. The simple rate of return answers the following question: “how much more, as a percentage, did my initial money grow?”

It’s also worth noting that you can have a negative rate of return, or a loss. It’s possible to put money into something and leave with less, which would translate to a negative rate of return in %.

How to Calculate Simple Rate of Return

For example, if you bought $100 worth of United States Postal Stamps 5 years ago, and they are now worth $120, you can calculate your simple rate of return!

Ending Value = $120, what your stamps are now worth, at the end of this 5 year period

Initial Value = $100, what you paid for your stamps initially, 5 years ago

($120 - 100) / $100 x 100% = 20%. Your stamps generated a simple rate of return of 20% over 5 years, or if you prefer annual return rates, a 4% rate of return each year.

Protip: If you don’t want to do adding or subtracting, you can actually use the following simplified formula:

Simple Rate of Return = Ending Value/Initial Value - 1 x 100%

$120 / 100 - 1 x 100%

1.2 - 1 = 0.20 x 100% = 20%

It’s like magic!

Steps to Calculate Simple Rate of Return:

Estimate the money you will receive at the end of the investment/business opportunity

Estimate the total initial or ongoing expenses you have to put in for the investment/business opportunity

Calculate simple rate of return using 1 of 2 formulas above

Another Example of Simple Rate of Return

You own a freelancing practice doing graphic design and illustrations. Recently, you’ve acquired a new client that has agreed to pay you $75,000 for a large project, spanning 6 months but you need to hire a software developer to help you tackle this project. To make the decision, you can use a simple rate of return formula to evaluate this opportunity.

Opportunity of cash inflow is $75,000

In order to take on this project, you will have to hire a contractor in a short time for 6 months and pay them $55,000 for the development work. In addition, the client requests the work be done on specific software and integrations which you may have to pay out of pocket for. Estimated costs for 6 months of software is $5,000.

$75,000 / ($55,000 + $5,000) - 1 x 100%

Simple Rate of Return = 25%

Now that you know you can expect to yield 25% on this project over 6 months–you can decide if this opportunity is worthwhile. Perhaps your rate of return with clients is usually well over 25% and closer to 75%, but because you have to hire a software developer, that return is heavily reduced. Using a simple rate of return formula can help you make difficult decisions.

Advantages and Disadvantages of the Simple Rate of Return:

Pros:

Incredibly simple to calculate

More than sufficient for a lot of scenarios without the need for additional considerations

Can apply to almost any situation without special regards to industry, etc.

Cons:

For more complex situations, the formula can be too shallow

If opportunity is very capital intensive, formula is too simple to account for opportunity costs

If the opportunity is over longer periods of time, can be too simple to account for lost opportunities

If the opportunity itself is complex i.e. makes periodic payouts to the investor, formula can be too simple to capture actual return

To better understand the cons of using the simple rate of return, let’s talk about some topics that may render the simple rate of return formula insufficient.

Time Value of Money | A Simple Rate of Return is Not Enough

If you’ve heard of the phrase the “time value of money”, you may be familiar with why in certain scenarios, a simple rate of return formula is not sufficient. The time value of money is a principle that states money received today is worth more than money received tomorrow. What does this mean?

If you had the option to receive $100 today, or receive $100 tomorrow, which would you pick?

Everyone would choose to receive $100 today and thus, $100 today is considered worth more than $100 tomorrow.

Since investing or business opportunities usually span over multiple years–if you’re tying up an amount of money over long periods of time, the simple rate of return formula does not take into account the true value of your money. Instead, the rate of return calculated would be higher than the actual rate of return, because you would actually be receiving the return some time later, instead of today.

In our previous example with stamps, your real rate of return is actually less than 20%, because you are receiving $120 five years later, and $120 five years later is not worth $120.

How much higher is the simple rate of return than your real return? Or how much less than $100 is $100 tomorrow worth? This brings us to the idea of the Discount Rate.

Discount Rate | How Money is Worth Less over Time

How much less is money tomorrow worth than money today? Using a discount rate means we have to “discount”, or reduce future cash flows in order to convert them to today’s value.

In practice, cash flows are divided by 1 plus the discount rate and raised to the number of periods from today. You would choose a discount rate that matches the opportunity at hand–we won’t cover the art of choosing a discount rate here, but know that different industries and opportunities call for different discount rates.

The Value of a Single Future Cash Flow Today = Future Cash Flow Amount / (1 + Discount Rate)^# of Periods

If we arbitrarily decide that the discount rate is 3%, then using our stamps example the value of $120 5 years later would be:

$120 / (1+0.03)^5 = ~$103.51, about a 3.5% return from the initial $100, 5 years later.

We can see that if we incorporate the time value of money, the real rate of return is much less than 20% at around 3.5%.

The above formula is the basis for the Discounted Cash Flow Analysis, or valuation (DCF Valuation) and is an important financial topic for those interested in Investment Banking and similar fields.

FAQs:

How do you calculate simple rate of return?

Simple rate of return is calculated as Ending Value minus Initial Value, divided by Initial Value times 100%. Alternatively, you can also use Ending Value divided by Initial Value minus one, times 100%.

What does the simple rate of return focus on?

The simple rate of return focuses on the return of simple investment opportunities with short time horizons and minimal interim cash flows. It treats all cash flows, regardless of how long in the future, as equals. In practice, it can be misleading if the time horizon is long or cash flows are complex.

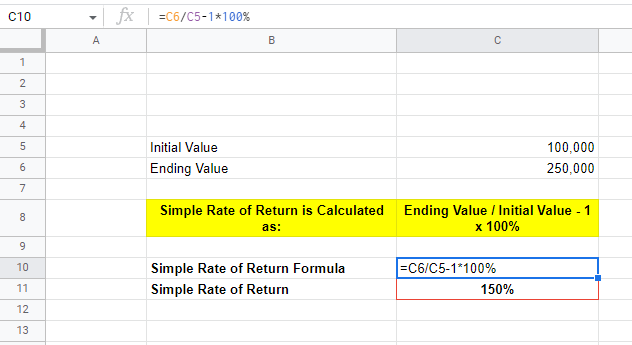

How do you calculate simple rate of return in Excel?

simple rate of return calculation in Excel

Simple Rate of Return = Ending Value / Initial Value - 1 x 100%

Simple Rate of Return = 250,000 / 100,000 - 1 x 100%

Simple Rate of Return = 2.5 - 1 x 100%

Simple Rate of Return = 150%