What is Relevant Cost | Making Business Decisions

Have you ever come across the term “relevant costs” and wondered what is relevant cost? Today, we’ll explore how relevant costs are used in managerial accounting to help businesses make critical decisions

What is Relevant Cost | An Important Distinction for Business Decisions

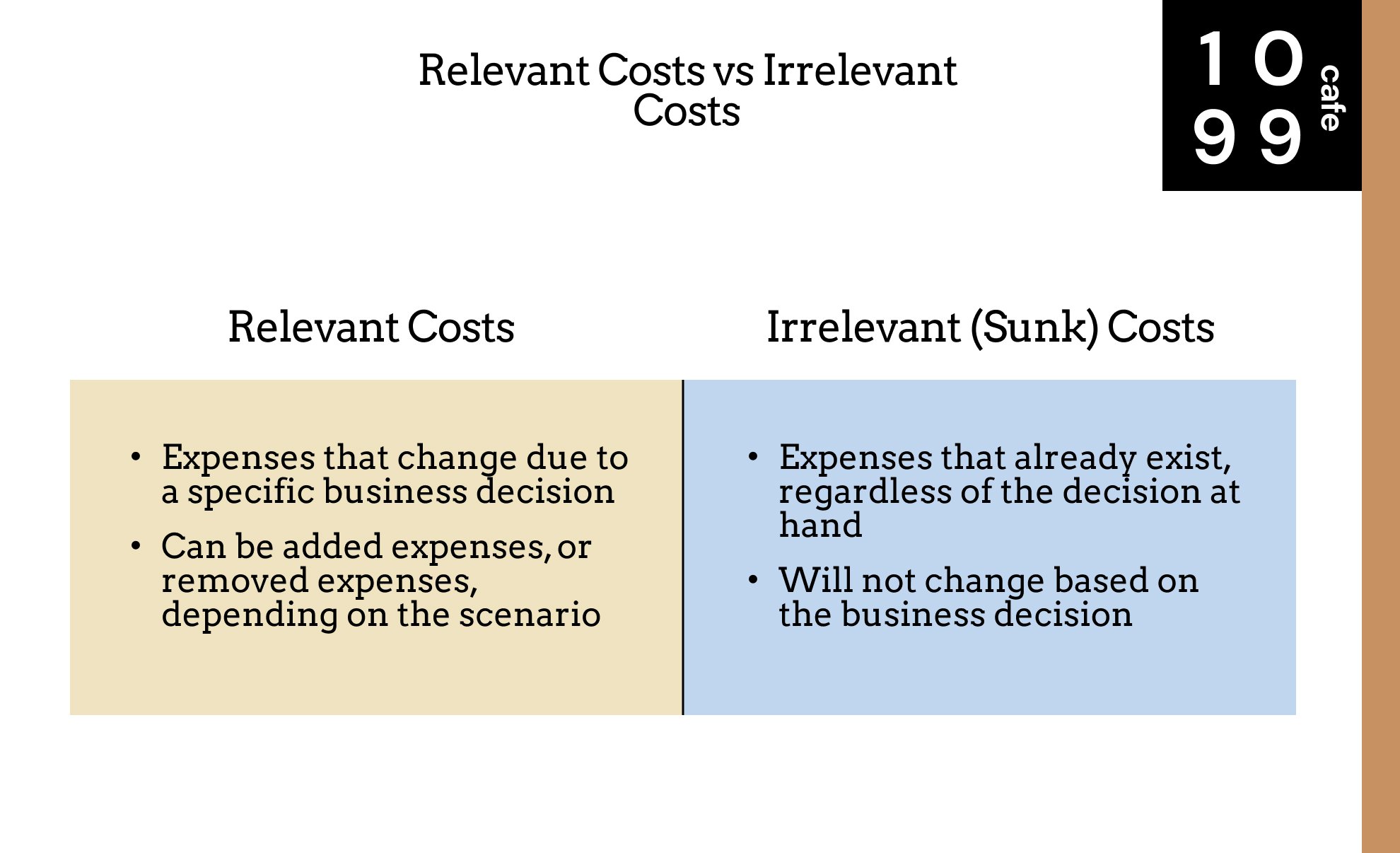

It may sound complicated, but relevant costs are actually quite simple. A relevant cost is simply any expense that changes resulting from a specific decision.

This is in contrast to an irrelevant cost, or sunk cost, which is any expense that already exists and will not change, regardless of the decision at hand.

Put simply, a relevant cost is an expense that changes as a result of a decision

what is relevant cost? A quick comparison

A quick example to highlight what is relevant cost:

The owner of a lemonade stand is deciding whether or not she should also sell orange juice. She is able to sell orange juice without expanding her existing storefront, or hiring any additional workers–she only needs to buy oranges in order to produce orange juice. What would be her relevant costs?

The cost of building the original lemonade stand

The cost of lemons

The cost of oranges

The cost of juicers

The answer is only C) The cost of oranges. Because all her existing equipment is already being used and she did not need to incur any additional costs to acquire new equipment or a storefront, none of those expenses are considered relevant. The only relevant cost in this case, is the cost of oranges.

Additional Examples of Relevant Costs

Some common examples that use the idea of relevant costs are highlighted below:

1) A business is deciding whether to make something in-house, or buy it: “Make or Buy”

Say a manufacturing plant makes and sells t-shirts and is considering going into the business of selling pants also. They anticipate making 10,000 pairs of pants and they can either make the pants in-house using new and existing equipment, or purchase pants from another manufacturer and sell them. Based on their existing relationships, the plant anticipates being able to buy the pants for $10 each for a total of $100,000.

Relevant costs for the business decision:

To make pants, the business needs to buy new machinery/assets which costs $50,000.

To operate the new machinery, the business needs to hire an extra employee at a $50,000 salary.

The new machinery also costs $5,000 a year in maintenance costs.

It costs $3 per pair of pants in additional raw materials, for a total of $30,000 for 10,000 pairs.

Total relevant costs for the first year = 50,000 + 50,000 + 5,000 + 30,000 = $135,000.

Here are some costs that the business does NOT have to consider and should not be a part of the analysis

Irrelevant costs for the business decision:

The pay for existing employees in the factory already

Any overhead expenses for the factory that already exists

Rental or lease expenses for other equipment that already exists

In this particular scenario, we can see that once we have separated out the relevant costs for the decision at hand, it’s a better business decision to buy 10,000 pairs of pants for $100,000 than produce it in-house for $135,000.

2) Evaluating the performance of a specific business unit

Suppose ABC company is in the business of selling both skateboards and snowboards and management is considering shutting down the snowboard business unit due to profitability concerns. We can use relevant costs to understand whether a specific business unit is worth keeping.

For the production of snowboards, ABC company requires:

A piece of machinery that requires $10,000 in annual maintenance

2 employees that operate and maintain the machinery, at $50,000 annual salary each

Raw materials costs of $35 per snowboard created

Based on the company’s sales reports, snowboard sales were 5,000 units at $100 retail price each in the previous season.

Relevant cost economics:

5,000 units x $100 = $500,000 revenue

5,000 units x $35 raw materials = $175,000 cost of goods sold

Minus

2 employees x $50,000 salaries = $100,000 wages and salaries

1 machine x $10,000 maintenance = $10,000 maintenance

Total profit = 500,000 - 175,000 - 100,000 - 10,000 = $215,000

In this scenario, we can see that after outlining the relevant costs for the snowboard production business unit, the department is still highly profitable and management should decide to keep this department. In fact, they should figure out ways to grow this business unit!

What is Relevant Cost Exactly? | Brief Summary

In short, relevant costs are expenses that change when a decision is made. Breaking relevant costs out is a good way to isolate portions of a business, or potential opportunities, in order to make an executive evaluation on whether to pursue new opportunities, or sever existing opportunities.

In contrast, irrelevant costs are costs that will not change after a decision is made. No matter what you decide, these costs will still be there, they are not “relevant” to the decision at hand.

FAQs:

What is meant by relevant costs?

Relevant costs are expenses that pertain to a specific business decision. They can be costs that are already in place and thus will be removed after the decision, or they can be new costs that would be incurred due to a decision.

What is a relevant cost example?

For example, if a lemonade stand were to consider selling orange juice as well, the relevant costs might be the additional cost of buying oranges, or the cost of a new juicer if the process is different from producing lemonade.

What is relevant cost and non relevant cost?

Relevant costs are expenses that will change after a decision is made and non relevant, or sunk costs, are costs that will not change after a decision is made.